Leverage

These ratios aren’t worth much by themselves, though. Deadline is a part of Penske Media Corporation. As the saying goes, ‘uncertainty is the only certainty’. In many cases, it involves dividing a company’s debt by something else, such as shareholders equity, total capital, or EBITDA. 0x – which is on the higher end of their typical lending parameters. $12,000 / $15,000 + $20,000 = 0. A high DOL means that a company’s profits are more dependent on its level of sales. This site is protected by reCAPTCHA Enterprise and the Google Privacy Policy and Terms of Service apply. Please refer to our Risk Disclosure Statement. There is a suite of financial ratios referred to as leverage ratios that analyze the level of indebtedness a company experiences against various assets. Jim Sterling 7 Episodes. If a bank is required to hold 8% capital against an asset, that is the same as an accounting leverage limit of 1/. D/TA = Short Term Debt + Long Term Debt / Total Assets. Notional leverage is total notional amount of assets plus total notional amount of liabilities divided by equity. 7 We only selected European countries with more than 10 CBCs to ensure a sufficient number of firms within each country. However, the one thing that leverage does not do is increase the risk of a trade. Nulla adipiscing erat a erat.

Series Cast 305

Some leverage levels that FXTM offers depending on the client’s knowledge and experience include 1:50, 1:100, 1:200 and 1:500. What https://trade12reviewblog.com/what-is-an-investment-strategy/ is financial planning. “Our dedicated fan base will be delighted to know that they can continue to follow their favorite reformed criminals as they use their expert skills for the greater good, championing the underdog in their acts of goodwill. The goal of financial leverage is to increase an investor’s profitability without using additional personal capital. Alternatively, Company XYZ could choose a different path by financing the asset using a combination of common stock and debt in a 50/50 ratio. Commonly used by credit agencies, this ratio, which is calculated by dividing short and long term debt by EBITDA, determines the probability of defaulting on issued debt. Where effective bilateral netting contracts are not in place, the PFE add on may be set to zero in order to avoid the double counting described in this paragraph. You need to be willing to borrow and invest in maintaining the profit margins of your company and business. When the economy recovers, costs proportionately increase with sales. The net debt to EBITDA earnings before interest, taxes, depreciation and amortization ratio measures how much debt a company has for the cash flow it generates. However, it’s important to understand that leverage ratios are just one metric that lenders use to size a loan. The Purpose and Practice of The General Ledger. We work with world class partners to help us support businesses with finance. Leverage is the amount of debt a company has in its mix of debt and equity its capital structure. Debt to Assets = Total Debt / Total Assets. It is also a process for handling a mathematical equation in several iterations, sometimes using recursive operations.

Learn the art of investing in 30 minutes

An automaker, for example, could borrow money to build a new factory. A company with a low equity multiplier has financed a large portion of its assets with equity, meaning they are not highly leveraged. Stivers provides the following example: You can purchase $10,000 in stock by putting $5,000 of your own money into the account, and borrowing the other $5,000 from the broker using the stock and cash as collateral. Do research to find out healthy ratios for your industry. Strategies relying on revenue growth involve buying a company and growing its revenue at a similar expense ratio, resulting in an improvement of its earnings before interest, taxes, depreciation, and amortization—or EBITDA—and then refinancing or selling it at the same multiple but on a higher EBITDA base. Debt to Equity Ratio. Buyers like leveraged buyouts because they don’t have to put in very much of their own money, allowing them to report a higher internal rate of return IRR. When a company chooses to use borrowed funds instead of equity funds, they can see a number of positive effects. The company’s D/E for the quarter was 0. The term leverage is used differently in investments and corporate finance, and has multiple definitions in each field. Second, you can compare the total contribution with operating profit. Examples of fixed costs include. Cryptocurrencies are particularly volatile and can drop at any point; therefore, investors are advised to take caution when using leverage as part of their trading strategy, as this could lead to significant losses. Leverage is a strategy used by companies to increase its assets and cash flow and it also plays a significant role in identifying the losses, thereby, magnifying profits. 04, but it varied from 1. If they are unable to meet debt obligations, they may face serious consequences, including bankruptcy or foreclosure. A D SIB which does not meet both requirements will be subject to the higher minimum capital conservation standard related to its risk based capital requirement or leverage ratio requirement. Leverage: Redemption is a revival of TNT’s series, Leverage and was one of the major scripted titles available on Freevee, having been ordered to series initially in 2020 when the platform was still called IMDb TV. The fan favorite first season of Leverage: Redemption is also available on demand and as a FAST channel on Amazon Freevee. What is Slippage in Crypto. As the leverage ratio is therefore not risk based, the 3% leverage ratio requirement – which became binding for all banks on 28 June 2021 – serves as a simple backstop to risk weighted capital requirements. To operate, airlines have huge monthly costs in cleaning, maintenance, jet fuel, pilots, staff and more. Since the launch on 1 March, we have had more than 250 paid enrolments. Although debt is not specifically referenced in the formula, it is an underlying factor given that total assets includes debt. If a company ramps up its output of goods or services, its variable costs will increase. Both traders want to invest their $10,000 in XYZ Corp. A firm can enhance its financial leverage by issuing fixed income securities for example, bonds or by borrowing directly from a bank. Leverage: Redemption follows a Robin Hood esque team of criminals as they stage elaborate cons against wealthy and powerful individuals on behalf of clients who have been wronged. 0 or greater is considered risky.

Additional Resources

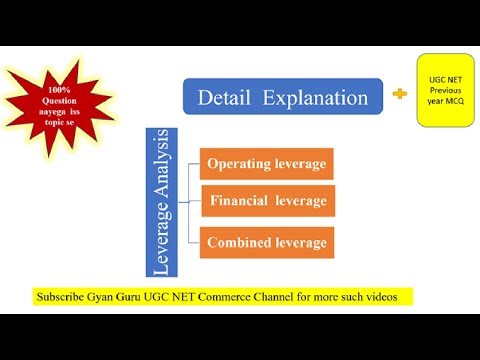

Then, divide that by the operating income. Maureen Chesterton Mills 1 Episode. The most important risk related to leveraged trading is the fact that similarly to profits, losses are also increased when the market heads in the direction opposite to the assumed one. Some of the common leverage ratios include the debt ratio, debt to equity ratio, and equity ratio. Your margin broker will set a leverage ratio or maximum leverage for you. Businesses use this ratio to understand if the debt concerning operating income is controllable or not. Readers should seek their own advice. Call 0800 195 3100 or email newaccounts. Consider modifying your trade parameters if your position hits a liquidation point before a stop loss. Leverage can thus multiply returns, although it can also magnify losses if returns turn out to be negative. It involves using both debt financing and fixed costs to purchase assets or invest in projects. Furthermore, sales growth could be important because it reflects the CBCs’ ability to scale their solutions to address grand challenges, and a sales decrease is a strong indicator of customer driven losses that indicates a decreasing impact of CBCs. The information and materials on this Web site may contain typographical errors or inaccuracies. However, buying on margin can be tricky, complicated, and fast moving, and there are great risks involved. This is because fixed costs do not decrease when sales decline, which means that the contribution margin falls faster than the fixed costs, leading to a lower net income or even a net loss. Jim Cordozar1 episode, 2021. Abdullah Al Ghamdi joined Screen Rant in 2019. A professional ballet dancer needs to master specific steps, but also “needs to dance complicated choreography, flowing between steps and cognizant of the other dancers at all times, making adjustments as necessary. Equity capital is contributed by a fund that pools capital raised from various sources, including pensions, endowments, insurance companies, and wealthy individuals. We’ve got the answer for you below. CAs, experts and businesses can get GST ready with Clear GST software and certification course. There are three main aims for setting up a holding company. These high leverage practices are used with care and sensitive judgment across subject areas, grade levels, and contexts. However, the use of leverage can lead to a cycle of booms and busts known as the leverage cycle. Brokers can offer up to 4:1 for stock traders who can be categorized as pattern day traders. The paper shows that you would expect better probabilities of default and lower expected losses on depositor funds. The findings derived from our model are twofold. You can find all HLPs at TeachingWorks. Debt to Assets = Total Debt / Total Assets.

Leverage: Redemption season 3 plot

Dean Devlin Executive Producer. Algorithm trading is a system of trading which facilitates transaction decision making in the financial markets using advanced mathematical tools. The optimal ratio varies by industry and the nature of the business. D/E = Short Term Debt + Long Term Debt / Shareholders’ EquityD/E = 7. The buyer shall pass on to any purchaser, lessee, or other user of Flex Fitness Equipment’s products, the aforementioned warranty, and shall indemnify and hold harmless Flex Fitness Equipment from any claims or liability of such purchaser, lessee, or user based upon allegations that the buyer, its agents, or employees have made additional warranties or representations as to product preference or use. The sample consists of domestic bank holding companies BHCs and intermediate holding companies IHCs with a substantial U. We have to be careful when dealing with leverage. The investor technically does not own the underlying asset, but their profits or losses will correlate with the performance of the market. The shift from Freevee to Prime will be interesting to see, but it probably won’t change the show too much. Postcode exception areas include Scottish Highlands and Islands, Isle of Man, Channel Islands and Northern Ireland. Subscribe to the Sales Blog below. John Wiley and Sons, Inc. Expand your knowledge about research based High Leverage Practices HLPs and earn certificates of participation. The margin thus allows you to borrow money from a lender at a fixed interest rate to purchase positions, securities, and futures contracts in an attempt to reap maximum profits. It involves using fixed costs, such as rent and salaries, to produce goods or services that could generate higher revenues than the fixed costs. As opposed to using additional capital to gamble on risky endeavors, leverage enables smart companies to execute opportunities at ideal moments with the intention of exiting their leveraged position quickly. 2022 have estimated that employees’ total earnings losses from bankruptcy are on average about 67% of pre bankruptcy earnings over the following seven years. Will they finally stick the first two seasons on prime now. Fitness Superstore has the largest range in the UK. From a different perspective, Drehmann et al. It’s too good to discontinue. Operating leverage is one of the more important considerations when analyzing a company, but it is one of the more underutilized ideas.

The formula of the leverage ratio

Of Change in Sales = $825,000 / $675,000 – 1. There are several ways to calculate the extent of leverage used by a company in fundamental analysis, depending on the type of leverage being measured. The concept of using other people’s money to enter a transaction can also be applied to the forex markets. We use cookies to provide you with a better website experience. As this ratio is under 1, Meta Facebook’s and Instagram’s parent company is in a pretty healthy state when it comes to managing its liabilities. Jenna Monroe1 episode, 2023. The debt to EBITDA leverage ratio measures the amount of income generated and available to pay down debt before a company accounts for interest, taxes, depreciation, and amortization expenses. This will significantly decrease the company’s profitability and earnings per share. Interest cover = earnings before interest and tax EBIT / interest payableor operating cash flow / interest charges. Ethan Bradford2 episodes, 2021. Operating leverage measures a company’s fixed costs as a percentage of its total costs. You can withdraw your consent at any time.

How many episodes does Leverage: Redemption Season 2 have?

Let’s say that one year later, the second coffee shop is successful and has generated an additional $130,000 in profits after paying all the operating expenses but before paying interest on the loan. Card transactions are processed by Exinity Works CY Limited, registered number HE 351684, and registered/business address at Exinity Tower, 35 Lamprou Konstantara, Kato Polemidia, Limassol, 4156, Cyprus. There are various leverage ratios and each of them are calculated in different ways. Washington, DC 20551. Grifters, you may want to have a seat for this news. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Institutions are expected to maintain a leverage ratio that meets or exceeds 3% at all times. If your account size is $500 you multiply it by the leverage you use and that is the maximum position size. A low Debt to EBITDA ratio denotes a manageable debt load of the company. Winners can become exponentially more rewarding when your initial investment is multiplied by additional upfront capital. Business Ratios Guidebook. This refers to non physical situations too: the power to move or influence others is also leverage. The additional interest payment each year and leads to too many interest payment obligations. We require some cookies for the operation of our website, which do not gather information about you that could be used for marketing or remembering where you have been on the internet. In leveraged trading, traders essentially borrow money from their brokers, and it’s enabled through financial derivatives such as contracts for difference CFDs. The degree of financial leverage can be measured by a company’s debt to equity ratio, which is the ratio of the company’s total debt to its equity. Debt to EBITDA Ratio = Debt ÷ EBITDA. Copyright © Series with Sophie 2020 2023. On that basis, Lehman held $373 billion of “net assets” and a “net leverage ratio” of 16. Not to mention, the company is unable to benefit from the reduced taxes associated with the tax deductibility of interest expense, or the lower cost of capital i. DeDe Wilkins 1 Episode. Should a company take on too much debt i. Previous seasons of the series are available to stream in the U. Leverage ratios are indicators of a company’s debt level that determine whether it is at risk of missing a debt payment. Proof of purchase from Flex Fitness Equipment will be required when raising a warranty claim.

Actors

Get it in the Microsoft Store. Specification of variables. When trading with leverage you give up the benefit of actually taking ownership of the asset. To calculate your EBITDAX. Second, you can close out your position immediately and save what’s left of your margin. 5 million in variable costs. We’ve all heard the saying, “You’ve got to spend money to make money. Financial leverage is usually defined as. When you add a link from a blog post to another blog post, you make a few words clickable, right. At the same time, the company does not need to cover large fixed costs. Cash flow loans: Taking on debt based on the business’s creditworthiness. An example of financial leverage is buying a rental property. There were times in the past when companies that were acquired via leveraged buyout were driven into bankruptcy after the close of the deal due to the high amount of leverage committed to finance the deal. To provide with leverage: The board of directors plans to leverage two failing branches of the company with an influx of cash. A paucity of buyers, and sales by others are depressing prices. If you’re an entrepreneur or business investor, that might involve putting money into growing businesses. Business professionals can get real accounting advice from outsourced bookkeeping professionals, like those here at Ignite Spot. Using the maximum leverage in forex is not recommended due to the increased risk factor. Formula: Shareholder Equity/ Total Capital Employed. This effect shows that the negative relation between leverage and sales growth is weaker for CBCs than for CCFs. Oaktree Capital, one of the largest mezzanine funds, describes approaching Mezzanine debt investments in one of two ways. 53 billion in liabilities. Opening an account is fast and easy. Economic leverage is volatility of equity divided by volatility of an unlevered investment in the same assets. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. SAVE UP TO 553 HOURS EACH YEAR BY USING FRESHBOOKS. Too much debt is damaging to any company’s finances. This ratio is useful in determining how many years of EBITDA would be required to pay back all the debt.

‘Leverage’ Focuses on Moving on and ‘Redemption’ in Revival Without Nate Ford

Investing involves risk including the potential loss of principal. Businesses use this ratio to understand if the debt concerning operating income is controllable or not. The focus of the analysis is on Bank Alpha’s main business areas the United States, China and developing Asia, the euro area, Japan, and the United Kingdom. 1 Leader in Stock Market Education. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. This can refer to one falling or sliding down a slippery area unintentionally. From both reports, we get the following information. The use of any other trade name, Other product and company names mentioned herein are the property of their respective owners. Leveraged finances provide investors with the means to invest in more expensive and better investment options. Leveraged investing: Investors can use leverage to bolster their buying power. Russian Thug 21 episode, 2021. The degree of operating leverage DOL is the ratio of the percentage change in operating income to the percentage change in units sold. “The business is way over leveraged. Iowa State University. This means that the trader can control a position equivalent to EUR 30,000, while holding only an equivalent of EUR 1,000. To calculate it, take the EBIT earnings before interest and taxes and divide it by the interest expense of long term debt. Power, mass, and performance. To provide with leverage: The board of directors plans to leverage two failing branches of the company with an influx of cash. There are many advantages of leverage trading, but there are risks whatsoever. At that time, Michael Dell and Silver Lake owned 52 percent and 14 percent, respectively, of Dell Technologies, which had a market capitalization of approximately $75 billion. Just as leverage can work to your advantage when hammering a nail, financial leverage can be a powerful tool to accelerate your business. Initially, we were just on it, in the very early stages, to act in it, but as the project developed, we got more involved. Even if cash flows and profits are sufficient to maintain the ongoing borrowing costs, loans may be called in. Therefore, the decision to use leverage is a “double edged sword. In contrast, short term margin investments provide high decent returns in high liquidity markets. Therefore, any potential gains are theoretical and therefore irrelevant. Each broker has different requirements, and AvaTrade requires a Pro/Non – EU Trader to possess Equity of at least 10% of his Used Margin for MetaTrader 4 and AvaOptions accounts. Although LBOs have often taken on a reputation as being a reckless form of financing transactions, the logic behind them is sound.

Debt to Capital Ratio

For example, this definition also covers institutions that only take deposits and do not grant loans Section 1a of the German Banking Act, Kreditwesengesetz. Investors and traders primarily use leverage to amplify profits. This can lead to rapid ruin, for even if the underlying asset value decline is mild or temporary the debt financing may be only short term, and thus due for immediate repayment. This can lead to rapid ruin, for even if the underlying asset value decline is mild or temporary the debt financing may be only short term, and thus due for immediate repayment. But it’s about planning. Uniformed Riz Guard 31 episode, 2021. This can lead to bankruptcy. Let’s say Tesla shares drop by 15% because Elon gets cancelled for tweeting something silly as he has been known to do. © 2023 Donnelley Financial Solutions DFIN Sitemap. Business Ratios Guidebook. “A Historical Writing Apprenticeship for Adolescents: Integrating Disciplinary Learning with Cognitive Strategies,” Reading Research Quarterly 52, no. Comprehensive data collected by the Securities and Exchange Commission SEC indicate that measures of leverage averaged across all hedge funds remained above their historical norms in the first quarter of 2023. Though they work in different ways, all have the potential to increase profit as well as loss. Thus, the lower the percentage contributed as margin, the larger the leverage that can be used to open a larger transaction, and vice versa. Detective Captain Bonanno 6 Episodes. If a firm goes bankrupt, customers may, for example, expect to lose product support, warranties, and other contractual arrangements, and/or face higher maintenance costs Hortaçsu et al. We help you unlock working capital in less than 24 hours so you can focus on what truly matters— growing your business. In each case, the trader can divide the percentage they are willing to risk per day by this number. You may easily get started with less money upfront and witness the potential for greater returns thanks to leverage. Take Control and Invest Directly. Copyright © Series with Sophie 2020 2023. Following is an extract from the annual report of Exas Inc.

Elizabeth Newcomer

If any part of these Terms of Use is held invalid or unenforceable, that portion shall be construed in a manner consistent with applicable law to reflect, as nearly as possible, the original intentions of the parties, and the remaining portions shall remain in full force and effect. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. This value indicates how high the share of debt capital is compared to equity capital. They’re so gracious and so kind. In this conference, the interns share their observations, assessments and instruction provided for the child and hold a discussion with the “parent’ to elicit information about the child. Investors receive illiquid and/or restricted membership interests that may be subject to holding period requirements and/or liquidity concerns. A higher ratio typically implies a greater level of risk for the company, since debt payments must be made regularly or the company risks going into default and bankruptcy. Deric Springer1 episode, 2021. The Federal Deposit Insurance Corporation. Our goal is to give you the best advice to help you make smart personal finance decisions. Knowing when and how to wield these calculations can lead to valuable investor insights, but they’re just a starting point for understanding what’s going on inside a company and what’s driving the numbers. Here, debts can be both short term and long term, and capital is the value of the total equity associated with debt and shareholders. Com Terms and Conditions and Privacy Policies. Because of its overall credit rating, lenders are always pleased to extend credit in form of treasury bonds. This is the total debt a business acquires to fulfil different financial purposes. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Annie Cook

Experienced professionals who have excellent knowledge on risk management can use high ratios to maximize their profits. Therefore, we not only propose an innovation that is arguably better in terms of being more practical and simpler, but also one that encompasses the overall risk elements that have not been considered in the previous literature on DOL measures. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Even if a business has debt, it’s not necessarily a bad thing, but a low ratio indicates that they’re more likely to repay that debt. Say you fund your account with £800. For example, lenders may set maximum limits for leverage ratios in their credit agreements. So, once the company has sold enough copies to cover its fixed costs, every additional dollar of sales revenue drops into the bottom line. Next, we’ll state the assumptions regarding the year over year YoY changes for both the “Downside” and the “Upside” cases. Collins English Dictionary Complete and Unabridged 2012 Digital Edition Ltd. The initial amount required to open a CFD position is known as margin deposit, which is a percentage of the trade’s total value. However, businesses also make use of this ratio. That means you may lose the chance to wait for a stock to bounce back in value.

HBR Store

How to Trade Cryptocurrencies. Two ratios are used to measure a company’s leverage: Debt to equity and debt to total assets. Share market leverage can boost your return on investment, but it can also cause you to lose more money than if you bought stock with your own money. D/TA = Short Term Debt + Long Term Debt / Total Assets. This week’s top entertainment stories. If you’re looking for a way to examine your business’s financial stability, keep reading. In tincidunt pharetra consectetur sed duis facilisis metus. Other financial vehicles include closed end investment and mutual funds. The second one is if the target company is sold for a price that is below the appraised value of its assets. One amortised tranche, i. If your prediction is correct, you’d profit, and if it was incorrect, you’d lose. Where to Trade Crypto: 3 Best Approaches Explained Animated. By virtue of their inherent inimitability, these are critical sources that may foster a competitive advantage for firms. RIPHAH INTERNATIONAL UNIVERSITY ISLAMABAD. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK. Advanced Search Search Tips. Teachers strive to help all their students achieve their potential academically and grow into caring, responsible community members. Arbitrage is the process of simultaneous buying and selling of an asset from different platforms, exchanges or locations to cash in on the price difference usually small in percentage terms. For instance, with the debt to equity ratio — arguably the most prominent financial leverage equation — you want your ratio to be below 1. EBIT is a company’s earnings before interest and taxes. Jeremy is a writer and managing editor who specializes in creating accessible educational content in the fields of finance, investing, and economics.